Arkansas

Arkansas real estate experts say mortgage rate is declining

Arkansas – The COVID-19 pandemic brought significant changes to the housing market, creating a scenario of constant fluctuation, particularly noticeable in mortgage rates. This has been a point of interest for both experts and those looking to buy or sell properties. Senior Mortgage Banker Mark Phillips recalls the period when mortgage rates were exceptionally low, sparking a buying and selling frenzy due to affordable borrowing costs. However, this trend experienced a dramatic shift as mortgage rates hit a 21-year high in August, only to start declining again recently.

Phillips notes that mortgage rates have now decreased to around 7%. While this might not seem significantly lower than the previous 8%, it substantially affects affordability. Lower rates mean reduced monthly payments, which can significantly impact a buyer’s budget. This change is especially crucial for first-time homebuyers, who Phillips advises to be aware of various programs that might offer even lower rates, depending on specific criteria such as the required downpayment.

Real Estate Executive Broker Tamra McMahon supports Phillips’s observations, emphasizing the opportunity that lower rates present. With more manageable monthly payments, buying a house becomes a more attractive and feasible option for many. McMahon also points out that these lower rates could lead to increased market activity. As rates drop, more people might decide to sell their current homes and upgrade, anticipating a surge in market demand as the year closes and the holiday season approaches.

Phillips remains cautiously optimistic about the future of mortgage rates. He anticipates that rates might remain stable for some time, expressing surprise if there were any significant increases in the near future. This stability could mean a more predictable market for both buyers and sellers, offering a semblance of normalcy after the tumultuous changes brought on by the pandemic.

The housing market, heavily impacted by the pandemic, is now experiencing a phase of adjustment with decreasing mortgage rates. This shift opens up new opportunities for potential buyers, particularly first-timers, and could lead to increased market activity in the coming months. As the year ends, those interested in the housing market should keep a close eye on these developments, potentially benefiting from the current trends.

-

Covid-191 year ago

Covid-191 year agoIngesting an excessive amount of vitamin D may result in serious health consequences

-

Arkansas2 years ago

Arkansas2 years agoHuman remains discovered near a popular Arkansas hiking trail believed to be person missing since 2021

-

Arkansas1 year ago

Arkansas1 year agoDriver in fatal single-vehicle accident in White County identified by authorities

-

Local News1 year ago

Local News1 year agoA Sylvan Hills High School student’s painting receives considerable acclaim

-

Arkansas3 years ago

Arkansas3 years agoArkansas Trying to Close Out Regular Season With Series Win Over Florida

-

Arkansas3 years ago

Arkansas3 years agoMickelson changes his mind, accepts exemption to US Open

-

Arkansas2 years ago

Arkansas2 years agoDue to the COVID Pandemic, Arkansas’ math and reading test scores have decreased

-

Covid-192 years ago

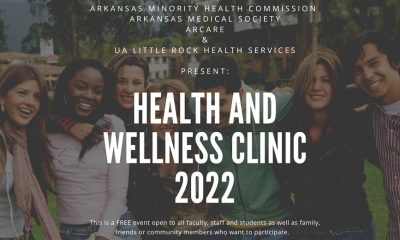

Covid-192 years agoHealth and Wellness Clinic will be held on November 3 at UA Little Rock

Leave a Reply